We have expanded our Deferred Revenue process to report 13 months of deferred billing. Plus we have the option of creating journal entries to track these transactions. This is a feature that must be activated by the support department.

![]() Note: Cycles must be set up to bill in advance to have deferred revenue reported.

Note: Cycles must be set up to bill in advance to have deferred revenue reported.

Set Up

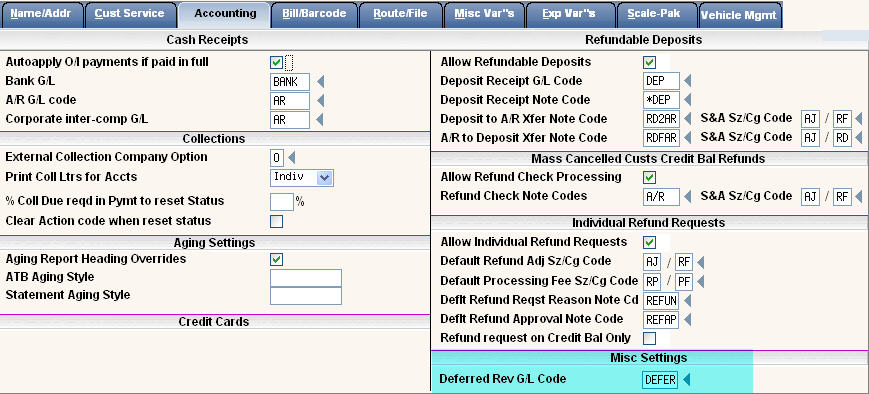

Company Master - Accounting Tab (From the main menu, select the System Administration menu. Then go to the Master Files menu to access option #1 = Company Master)

Under Misc Settings, enter the Deferred Revenue G/L Code you want to use for this company.

![]() Make sure this G/L code is a valid entry in your GL Code Master.

Make sure this G/L code is a valid entry in your GL Code Master.

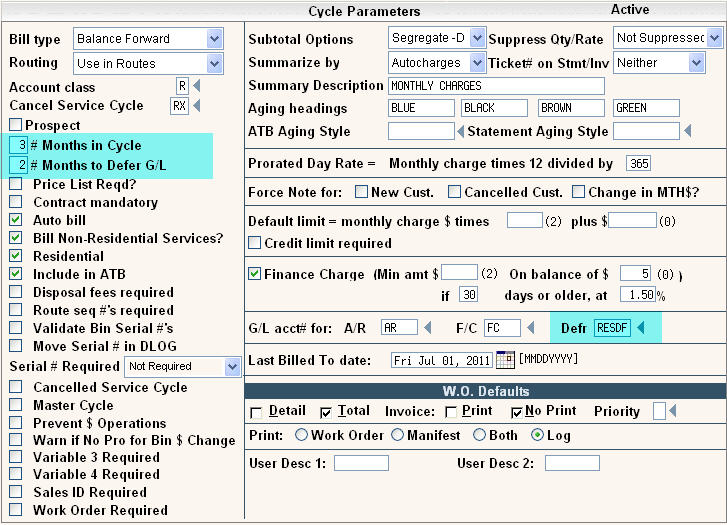

Cycle Master (Option #4 from the Master Files menu)

The deferred revenue GL code can also be defined at the Cycle level.

In the G/L acct# for: DEFR section on the right, enter the deferred revenue G/L code you want to use for revenue deferred in this cycle. If this field is blank, the Deferred Revenue G/L from the Company Master record will be used.

In the # Months in Cycle, enter the number of months to auto charge. In this example, the cycle is a residential quarterly cycle billed for 3 months at a time.

In the # Months to Defer, enter the number of months that you want deferred. In this example, the cycle is set to defer 2 months, so 1 month will be considered current. The programs take the total auto charges and divides that amount by the # Months in Cycle to get a monthly charge. Then it defers that amount into however many months you have set up in the # Months to Defer field.

Reports

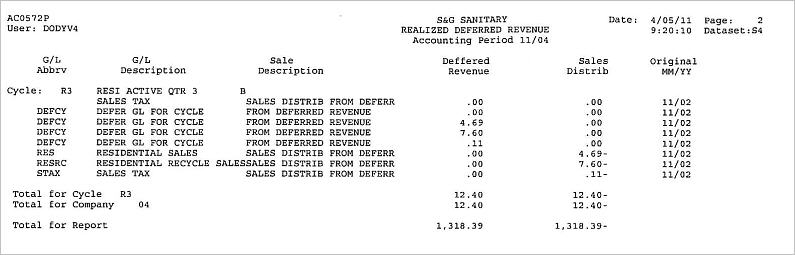

When month end is run, two new reports will be generated. They are both titled Realized Deferred Revenue but have different report names. The first is AC0570P1 and it breaks down the Deferred Revenue by months. There is an example below to show how it works. Cycle R3 is a 3 month cycle that had a $4.69 per month in Residential Sales. This cycle is set to bill for 3 months but defer 2 months. At month end, the programs put $4.69 into the current month and a total of $9.38 was deferred. $4.69 in +1 month and $4.69 in +2 months.

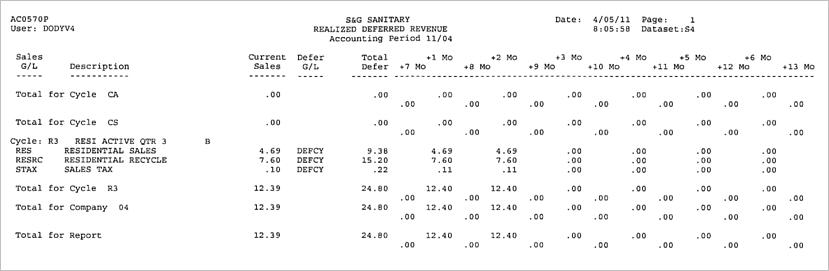

The second report is also titled Realized Deferred Revenue but named AC0572P1. It lists out the journal entries that get created with this process. All deferred journal entries are held in the GLDEF file until they populate into the i-Pak General Ledger (GLFL) during the next month end.