The Tax Body Master Mass Update was designed to assist you in updating the Tax Body master for multiple codes at one time.

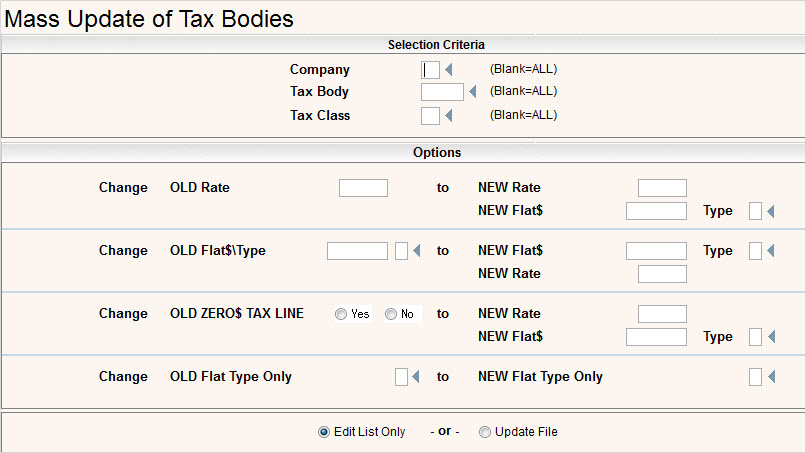

Select the option from the System Administration Menu and the Mass Update of Tax Bodies selection screen will be displayed.

In the Company field enter the company you wish to update Tax Bodies for. Leave blank if you want to update all companies

In the Tax Body field enter the Tax Body you want to update. Leave blank if you want all tax bodies to be updated.

In the Tax Class field enter the Tax Class you want to update. Leave blank if you want all tax classes to be updated.

Options:

Change OLD Rate: Enter the existing price from the tax body master records that you want to change in the first field. Then enter the NEW Rate price into the Rate field to keep the Tax Body as a Rate. If you want to change it from a Rate to a Flat, then enter the new price into the NEW Flat$ field and select which Flat Tax Type you want the Tax Body entry to be updated with.

Change OLD Flat$/Type: Enter the existing price and Flat Tax Type that you want to change in the first fields. Then enter the new price into the NEW Flat$ and Type fields. If entering a Flat Tax, you must enter a Flat Tax Type as well. If you want to change the Flat tax to a Rate tax, then enter the new rate into the NEW Rate field.

Change OLD ZERO$ TAX LINE: This option will allow you to change a tax line with no dollars on it, and therefore no settings for Flat or Rate, and update those lines with a NEW Rate or New Flat$ and Type.

Change OLD Flat Type Only: If you only want to change the Type of Flat Tax that you are using, you can enter your OLD Flat Type in the first entry field and the NEW Flat type in the second entry field.

Edit List Only or Update File:

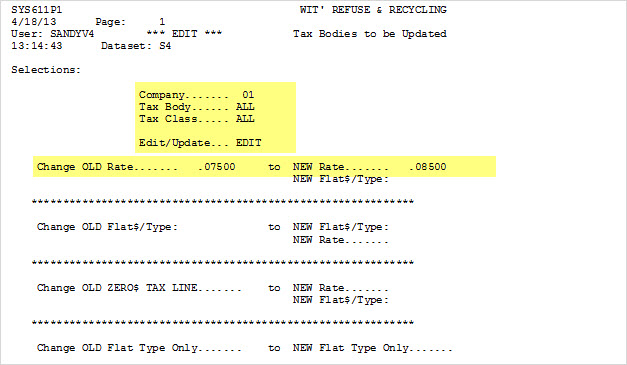

Edit List Only: If you select to run an Edit List Only, then no update will occur in the Tax Body Master File. A report named will be generated that will show you which Tax Body records will be changed if you choose to run the Update. The word *** EDIT *** will print at the top of the report to show that this is an Edit List only and no updates will have been made.

Update File: If you select Update File instead of Edit List Only, then the Tax Body Master File will be updated with the changes selected and you will receive the 2 reports listed below to show what changes have been made. The word *** Update *** will print at the top of the SYS611P1 report to show that these selections should be complete in the Tax Body Master File.

![]() We strongly suggest that you do an Edit List Only and review the changes before choosing the Update File option.

We strongly suggest that you do an Edit List Only and review the changes before choosing the Update File option.

Click or press ![]() to confirm the selections and run the edit or update. You will be brought back to the Mass Update of Tax Bodies screen once the Edit or Update has been confirmed so you can make additional selections.

to confirm the selections and run the edit or update. You will be brought back to the Mass Update of Tax Bodies screen once the Edit or Update has been confirmed so you can make additional selections.

REPORTS

There are two reports that can be generated from running the edit or update.

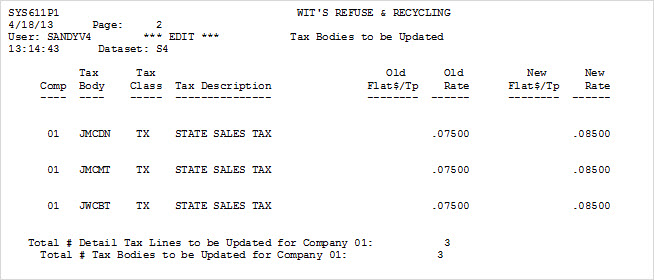

SYS611P1 - This is a listing of tax bodies that were successfully updated by this process. The first page contains the selection criteria and the following pages will contain the actual records that will be updated.

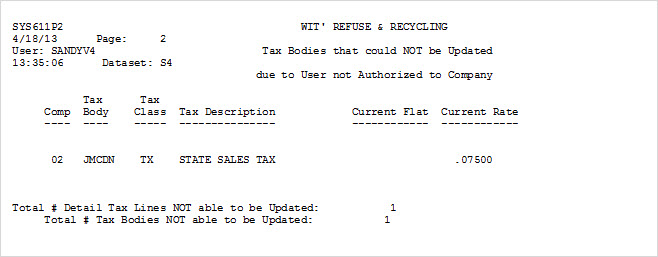

SYS611P2 - This is a listing of tax bodies that could not be updated due to the user not having correct authority to the companies selected.